By now, you’ve heard of the world’s two best nomad travel insurance options, Safetywing vs World Nomads. Here’s a clean breakdown of them both for 2026, side by side.

As this is the new Hobo with a Laptop; we’re starting over from scratch, lost the original database, and we were offline for over a year –this article lost all of its original comments; you can view the original article here to read comments from before 2025.

Editor’s Note

There’s been a new development: You won’t find this comparison anywhere else because it’s actually against all of the rules to put them side-by-side –because Australia law doesn’t like an informed consumer (in my opinion).

Most bloggers won’t spill it like I do. I might lose World Nomads as a partner (ie. lose money) because they’re based in Australia and they can’t have me as an affiliate if I don’t follow Australian regulations. And I’m happy to give up the income, just to keep this post live, updated, unbiased, transparent, and accurate for you my friendly reader because this is one of our most popular posts.

If you find this nomad insurance comparison useful and actually choose World Nomads insurance, I won’t get a commission –you could consider becoming a supporter, for keeping it real in spite of silly laws from the open air prison island we all call Australia. (Australia regs even made World Nomads’ old “get a quote” widget illegal! Like, that’s going full rtrd).

World Nomads and Safetywing are both awesome in their own way –Australia, not so much. We can’t help where we’re born.

Alright, let’s go!

This article was last updated on February 15, 2026. And because I love lawyers so much and this article is about insurance, (sadly) the first chunk of the article is devoted to verbiage that would make a vampire blush.

I hope I covered all my bases.

Overview

The logistics that come with starting a digital nomad lifestyle are the main barrier to entry for most people who want to live abroad in exotic (yet more affordable) countries, work remotely on their laptop, and take advantage of currency exchange rates to improve their quality of life.

I speak from experience when I say that travel insurance is one of the primary obstacles that raises doubts and confusion for aspiring digital nomads. Sure, there’s other obstacles to becoming a digital nomad but long-term travel insurance is high on the list.

With that in mind, my aim with this article is to set proper expectations and provide a comprehensive, easy to understand guide to compare travel insurance for long-term international travelers and digital nomads alike.

In a post-coronavirus world, and in my opinion alone, every digital nomad should have travel medical insurance. Both travel insurance companies on this list won’t like it if I tell you that you “should” “must” “need” insurance. So I won’t say that. Because everyone simply loves lawyers as much as they love their girlfriend’s boyfriend.

This guide provides details about coverage for both US citizens and non US citizens. Both of these companies insure citizens of almost every country on the planet.

The majority of digital nomads I’ve met either through Hobo with a Laptop or in person use World Nomads vs SafetyWing insurance without issue (and a majority of our readers choosing Safetywing), although US citizens have the affordable care act (Obamacare) to consider. And that’s why I focus much of this guide on those two brands.

Is This Guide for You?

If you’re reading this insurance guide you’re likely to be:

- Traveling a minimum of 30 days in 1 or more foreign countries

- An open book in terms of your location

- Semi off-grid at times, far from a hospital or capable doctor

- Taking risks by using a motorbike or “adventure sports” activities like scuba diving, climbing, off-roading

- Possess electronics that are important, fragile, likely expensive, and theftworthy (ie. need laptop travel insurance, too)

- Some readers may have a chronic illness like diabetes to contend with on a daily basis

You may not have a plan in terms of your location, so you’re likely going to need international health insurance that will cover you wherever you roam, for however long that is, planned or otherwise.

From my understanding, many old school expat insurance providers require your full travel itinerary in advance and have a maximum coverage term that adds to the headache.

For the sake of this guide, we’re focusing on World Nomads vs SafetyWing; two nomad travel health insurances brands that have flexible coverage wherever you might wind up, and they both allow you to change, update, or renew your policy online while you’re still on the road.

Related: How to Become a Digital Nomad, Step-by-Step

Editorial Purposes Only

By reading this guide you agree to our site policies –in particular, the disclaimer that says something along the lines of Hobo with a Laptop and it’s authors not being liable for any misinformation, outdated information, or harm of any kind that comes to you as a result of reading it.

I’ve written this comparison to the best of my knowledge and understanding as a digital nomad of 7+ years, but mistakes or changes to insurance policy terms can happen. Use the information within these honest travel insurance reviews at your own risk and discretion, it is provided for editorial purposes only.

I have not been paid to endorse one insurance provider over another although I am an affiliate for both World Nomads and SafetyWing, and in that, I’m not partial to whichever you may choose.

Everyone has different needs, therefore I will not endorse one company over the other. What I consider the best travel insurance may not work for you.

Related: What’s the Best GPS Tracker for Traveling, Kids, Pets, and Luggage?

Nomad Travel Insurance

If you’re in the market to get nomad insurance because you plan to hop on a one-way flight and travel long-term on an open-ended planetary hullabaloo, the best way to go about it is to go through the sign up process and/or get a travel insurance quote online without necessarily giving your credit card number before calling support to speak to a human being who can answer any additional questions you will have.

After you do a dry run and you’re familiar with the policy and procedure that’s customized for people in your region/country, pick up the phone and flesh out answers to questions that may not have been answered.

Customer service reps are extra helpful when they know you’re about to pull the trigger on a policy purchase.

Know Your Coverage Inside and Out

Some questions you might want to ask before signing up for long-term travel insurance include;

- What’s the deductible on health-related claims like paying for a ride in an ambulance (extraction), treating an injury (cuts and scrapes), or a medical procedure like a surgery or emergency dental work? Are these things even included?

- What are the requirements for making a claim on lost or stolen luggage? What if your wallet is stolen? Do you need to observe the crime take place? How do you prove it? What are grounds for not being covered?

- What’s the deductible on your gear?

- For laptop travel insurance –what’s the “book value” of your laptop model?

- How many business days will it take to be reimbursed on a claim? Keep this in mind, as it’s normal to pay out of pocket, up front, for expenses and be reimbursed at a later date

- What sort of activities are covered? ie. Riding a motorbike or scooter, scuba diving, rock climbing, hiking, and other “adventure activities”

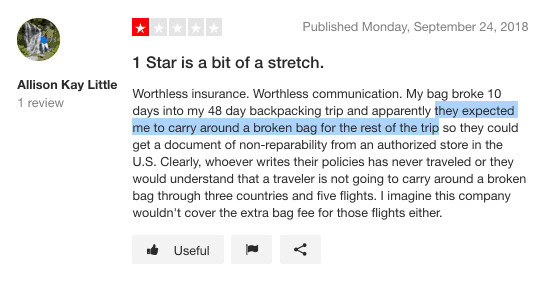

- Are there elements of any claim that may require you being physically in my home country? ie. “document of non-repairability from your home country” —and if so, how much time do you have before you must actually go home and produce it in order to be compensated?

- If a US citizen –How does this policy relate to the affordable care act (Obamacare)?

Consider reading bad reviews about nomad travel insurance providers before you phone in, before you sign up for a policy –and write down questions based on other people’s negative experiences so you’re not one of them.

I’ll supply links to TrustPilot reviews for both brands later in this travel insurance comparison.

Remember: They’re Not Your Friend

Ask questions! Don’t take anything on faith! When I read negative reviews for anything, I’ll often think “boy, glad I asked that question before I signed up”.

Questions are also a really great way to figure out how not to get f*cked by your provider in a crisis situation when you’re making an insurance claim.

In my mind, insurance companies respectfully fall into the same category as lawyers, police officers, and online grammar nazis –everything you say can and will be used against you. There’s little room for benefit of the doubt. They’re honest, but legalistic.

A sunny rapport doesn’t mean you won’t trip up a claim on a technicality, how you frame a situation, or with semantics.

Or with your social media posts. Because long-term travel insurance companies may look at social media if you file a claim, to verify that your case is within your coverage. Not your friend, no, nooo. Although you can’t really blame them, it’s creepy smart.

Be polite, but frank. Use short sentences. Ask questions before making statements if you’re unclear on something so you know how to answer them in the legalistic way they’re viewing your claim. Only provide answers to questions, don’t tell stories. Pretend they hate you and they just read your diary.

Losing a claim could be as simple as providing too much superfluous information or not asking a question before you provide an answer –or trudge over to an internet cafe to scan and email the wrong document.

Have an Emergency Fund

And finally, always expect to pay for all expenses you’re covered for out of pocket, first.

Most hospitals around the world don’t have a computer link-up to your insurance policy provider’s computer –meaning that it could be weeks until you get your money back, sans deductible.

Same goes for damaged luggage. Insurance companies have insurance and a line of credit, too. They need to provide a paper trail to the higher-ups, and often that means you’re on your own, if only for a little while. Claims take time to process.

Expect delays at the onset of a problem and you might be pleasantly surprised. As opposed to expecting too much too fast, and getting f*cked.

A majority of complaints I see about digital nomad insurance claims online are because policy holders think that they’re entitled to getting things replaced immediately, on their word without formal verification, while they’re traveling. Sadly it doesn’t work that way.

If you’re underprepared, I’ve known a few US citizens who have had success getting a fast loan with next-day turnover to cover costs while travelling health insurance claims were filed and fulfilled.

Insurance Lingo

There are a few terms I feel you should understand, in plain English, before we begin.

Health Insurance

Health insurance (international) is a must for digital nomads, and it differs from travel insurance –although both SafetyWing and World Nomads cover both health and travel to some degree.

While outside of your home country you may not be covered by pre existing insurance policies or government healthcare back home because you’re outside of said home country for a particular amount of time.

Health insurance can cover things like:

- Coverage of medical, surgical, and/or treatment costs associated to unexpected illnesses, dental emergencies, or injuries

- Pay for physical extraction –like, say, if a helicopter was required to pull you out of a jungle, ambulance, etc.

Travel Insurance

Travel insurance is for when something goes wrong, trip-wise, such as:

- Flight cancellations

- Trip interruptions

- Lost, damaged, or stolen luggage items

Travel insurance cost for nomad gear could include freak accidents like someone stealing your laptop or it getting soaked during Songkran in Thailand (guilty! And covered by World Nomads after my first year abroad).

Worth mention is that airline booking sites and/or the credit card company you use can also provide additional world travel insurance to compliment a policy by either SafetyWing or World Nomads.

I won’t pull any punches; SafetyWing insurance lacks in coverage when compared to World Nomads travel insurance reviews, but it’s not necessarily a shortcoming (and potentially a huge cost savings because it isn’t overkill).

If you investigate the world travel insurance coverage provided by your credit card company, travel agent or airline booking site, additional travel insurance you might already have without knowing it could compliment SafetyWing’s cheap insurance, nicely.

It could be considered a smart move on the part of SafetyWing to leave out some of the coverage its competitors offer in order to keep your monthly costs down.

Insurance Deductible

An insurance deductible is the amount you pay for services or losses before your insurance provider starts to pick up the tab.

For example, with a $500 deductible you pay the first $500 of covered services or losses yourself.

After you pay your deductible, you coverage is usually only a book value (of say, your laptop –ask your insurance company what that is), copayment, or coinsurance for covered services and/or losses.

EXPAT INSURANCE SHOWDOWN!

World Nomads vs SafetyWing

If you’ve done your research on travel insurance, Reddit will say that World Nomads and SafetyWing are the two most noteworthy providers of travel insurance for digital nomads –the two companies that a majority of nomads talk about, refer, and endorse.

World Nomads and SafetyWing are available to people from hundreds of countries, internationally, all over the planet. They’re sort of like the Skyscanner of travel insurance policies, partnering with the most competitive in your home country to bring you the best possible coverage for a fraction of what it would typically cost.

When compared to the direct-to-consumer pricing of an underwriting insurance company, I’ve found that the buying power of both Safetywing and World Nomads insurance makes rates more competitive, and at a lower cost in many cases.

Best Travel Insurance Companies?

Why World Nomads and Safetywing are on this travel insurance comparison;

- They are both incredibly competitive on price, flexibility, and coverage because they aren’t tied down with massive infrastructure –they’re online shops with low overhead and they pass on that savings to you

- You can sign up for either nomad travel insurance brand from the road, after you’ve started your adventure

- Both services require you to have a home address in your home country, but you won’t need to be there when you sign up online

- The sign up process for both of these nomad insurance providers is fully online, quick, affordable, flexible, and generally the best a digital nomad could hope for

- Neither of these insurers have a “maximum coverage term”, so you can keep renewing your policy as long as you’re traveling

Your choice of international health insurance boils down to the coverage you’re looking for at a price you can afford.

However, there are differences between these nomad insurance companies. Let’s discuss the differences between them in this SafetyWing vs World Nomads travel insurance review.

World Nomads Review

Pricing

World Nomads insurance coverage starts at approximately $100+/month, check their website for some regionalized coverage information.

Introduction

World Nomads travel insurance comes at a slightly higher price point vs SafetyWing travel insurance, but it has greater coverage and makes a great primary provider. Meaning that with World Nomads, there’s a likelihood it’s all the insurance you need.

World Nomads has a comprehensive offering with excellent coverage for health insurance internationally, as well as laptop travel insurance.

World Nomads insurance appears to have been first in terms of travel insurance, and is endorsed by key publications like Lonely Planet and influential travel blogger Nomadic Matt.

World Nomads Travel Insurance Review

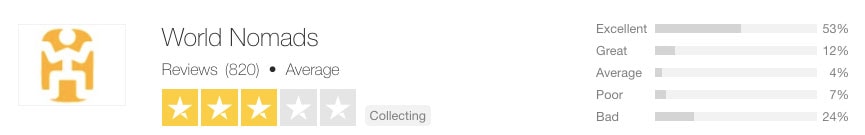

TrustPilot has an overall average World Nomads travel insurance review of 3/5 stars:

You can view the World Nomads review on TrustPilot and see how they got this rating.

What’s Covered

Here’s a few notable examples of what is and isn’t covered with World Nomads travel insurance:

- Note that World Nomads has 2 tiers of insurance; “Standard” and “Explorer” –the latter being more comprehensive

- Travel delays including missed, delayed, cancelled flights

- Lost checked luggage, stolen/damaged gear including laptop travel insurance, GoPro cameras, tablets, smart phone, digital storage devices, cameras and lenses, etc. Under the explorer plan you are covered for up to $2000 per item

- Worldwide coverage, except for North Korea, Cuba and Iran

- US citizens have coverage in the United States

- Health coverage for unexpected injuries and illnesses due to “adventure activities” or sports (if “Explorer” policy), dental emergencies, hospital stay, prescriptions, doctors, and emergency medical evacuation (extraction)

- Not covered: Pre existing conditions of 6 months prior to coverage, cancer treatment, routine checkups, preventative care

Safetywing Review

Pricing

SafetyWing insurance coverage starts at approximately $37+/4 weeks (which you can break up, it doesn’t need to be consecutive –huge plus).

Introduction

SafetyWing is a noticeably cheap travel insurance brand than World Nomads, although its coverage varies in a number of different ways. Meaning that you might retain insurance you had back home, or that of your travel agent, booking site, or your credit card company and use SafetyWing to fill in a few of the blanks.

SafetyWing serves as a hybrid of both health insurance for nomads, as well as travel insurance.

SafetyWing is the new kid on the block and presents admirable competition to World Nomads. It was started by nomads, for nomads.

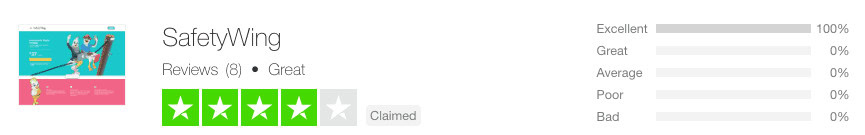

SafetyWing Travel Insurance Review

TrustPilot has an overall positive SafetyWing travel insurance review of 4/5 stars:

You can view the SafetyWing review on TrustPilot and see how they got this rating.

What’s Covered

Here’s a few notable examples of what is and isn’t covered with SafetyWing’s nomad travel insurance:

- Travel delays out of your control, does not include missed flights

- Lost checked luggage is covered, and expensive electronics like laptops, GoPro cameras, iPads, tablets, cameras, lenses, etc.

- Worldwide coverage except for North Korea, Cuba and Iran, and coverage in the US costs an extra $31/4 weeks

- 30 days for every 90 days of medical coverage in your home country –unless you’re a US citizen– if the US is your home country you get 15 days of coverage for every 90 days you’re there (a rarity for travel insurance)

- Health coverage for unexpected injuries and illnesses; hospital stay, prescriptions, doctors, and emergency medical evacuation (extraction), only acute onset of pre existing conditions are included in some cases

- Not covered: Pre existing conditions, cancer treatment, routine checkups, preventative care and there’s limited coverage for sports and adventure activities

Confirm all the details above before you purchase your travel insurance nomad policy because some details related to your coverage may have changed.

Safetywing’s Dynamism (Anecdote)

Safetywing deserves a pat on the back for being the first nomad insurance company to offer COVID-19 insurance early into the pandemic; they covered treatment and obligatory quarantine costs if it was unexpectedly decreed by a medical professional to do so, you were not in your home country, and had coverage for over 28 days prior.

The payout for quarantine was $50 per day, up to 10 days. Not the biggest payout, but they were the only ones doing this if I recall –they jumped through regulatory hoops for their customers to adapt quickly and ease the blow brought on by the mishandling of the pandemic. If you were on the road at that time, I am confident you’d have been quite pleased.

My Travel Insurance Experience

I’ve personally started my digital nomad life with World Nomads travel insurance as my provider, although later switched to Safetywing –which is the most popular travel insurance with our readers today. Back when I got World Nomads travel insurance, Safetywing wasn’t a thing, and I read all the World Nomads travel insurance reviews I could get my eyes on.

When I made a claim on a non-health related issue World Nomads were quick –much quicker than I’d expected, and without too many hoops to jump through. So, I have nothing negative to say about them.

It was for a water damaged laptop and it wasn’t a nightmare, as I had the means to print, sign, scan, and email my claim information at a local tattoo shop in Ao Nang, Krabi, Thailand at that time.

The TrustPilot reviews say something else. There’s a lot of possible reasons for that and I will stand aside and let you be the judge. I love TrustPilot, I just don’t trust every user who’s ever written a review on it.

In either case, I think either travel insurance for digital nomads deliver potent value for the cost of their coverage and will continue to grow and improve.

I just went with Safetywing later on to save money, as the coverage, for my needs, is relatively the same.

My needs dictate my solution, I think both insurers offer a great service or they wouldn’t be on Hobo with a Laptop. As previously mentioned, a majority of our readers choose Safetywing over World Nomads. There’s a very good reason for that.

Safetywing has come out on top as being the most affordable, by far, with minor differences in what they offer.

Buy Expat Insurance & Have Emergency Money

At the end of the day, you don’t want to make the leap into digital nomadism without proper expat insurance and emergency money. We’re all fragile, we all have others who rely on and love us, and our meat sacks –as impressive as they may be– are fallible.

Things can fall apart quickly and it’s scary as hell.

Our best experiences, those that test our mettle, often come with a few scrapes, road rash, bruises, jellyfish stings, perhaps parasites or internal bleeding, and maybe even a couple days attached to a machine. Make sure you can afford that machine.

Laptops are expensive and we rely on them to tether ourselves to reality to sustain, but our bodies are one of a kind.

We know that most bloggers make it look carefree, but the truth is, it’s anything but. Even I’m guilty of that carefree bullshit. These photos I use –come on.

Look around, plenty of us nomads who came before you have f*cked up royally –and that’s not what GoFundMe is for; can you imagine being in a hospital relying on a GoFundMe campaign because you didn’t have nomad travel insurance?

Most of us have some form of digital nomad-friendly insurance with one provider or another.

Maybe it’s your credit card company, it came with your flight booking, or in the least, you go with a cheap travel insurance policy that covers a few important bases.

If you can’t afford travel insurance, it’s my guess that you probably shouldn’t become a digital nomad just yet.

Know anyone looking for a Safetywing review, or a World Nomads review? Share it!

Don’t Risk It –Get a Quote From Both Travel Insurance Companies

We’ve all got our priorities and opinions will vary on what constitutes the best travel insurance. Find out exactly what your options are, written in black and white, from each provider.

Click on World Nomads or SafetyWing insurance to learn more about how they can make sure you’re looked after if you run into trouble on the road.

If you buy a policy we’ll make a small cut to help make Hobo with a Laptop worthwhile, at no cost to you –and we make more if you choose World Nomads because they cost a bit more.

What do you think? If we made a mistake in this travel insurance comparison, or there’s a shiny new travel insurance nomad contender –please let us and everyone else know in the comments.

YOUR IP ADDRESS IS SHOWING!

It's 103.62.152.130

Consider using a VPN to mask identifiable information that can be used by hackers and governments around the world to decipher your physical location and observe your private browsing habits. Make it look like you're in a different location and get region-specific content. Watch American Netflix all over the world, even if you're in the Philippines.