Remote Health is a brand new freelancer health insurance product by Safetywing that launched on September 18, 2020. This article was updated on April 6, 2021.

This health insurance is for businesses who want to offer health insurance for their staff, and solo self-employed people, entrepreneurs, freelance “gig economy” workers, and those who work from home and need coverage if their employer doesn’t offer it.

This health insurance business has no exclusions for pandemics, meaning that it has medical coverage for COVID treatment (and cancer, too).

Are you looking for travel insurance with COVID coverage instead? If so, click here.

Are you a business looking to insure your employees? If so, click here.

Health Benefits for All

Remote Health by Safetywing is economical and easy to manage –great if you’d like to cover only yourself, and/or your team, and/or your family all in one dashboard.

It is health insurance for independent contractors who work on a job site, on any “gig economy” site like Upwork, Uber, Fiverr –or if you’re an entrepreneur, freelancer, work from home mom or dad, or simply aren’t already covered by an existing employer.

Click here to learn more about their economical rates and get answers to any questions you may have. We live in interesting times –you never know what might happen tomorrow.

Learn MoreSelf Employed Health Insurance Business

Safetywing is already a well-known travel insurance company that’s popular among expats and digital nomads due to its affordability and ease of use for international policy holders.

Whether you’re living in California, Toronto, Hamburg, Da Nang, or Mumbai with members of your team spread out around the world –Remote Health could be the best health insurance for self employed, for you and/or your team due to its low cost, scalability, and universal access.

Click here to find out if you or your staff are in a country that’s eligible for Remote Health.

In this article we’ll explain what’s covered by Remote Health and in an upcoming article we’ll compare it to competing health insurance for entrepreneurs and freelancers.

Why Freelancer Health Insurance?

You probably already know why if you’re here, but here’s my story; I’ve been self employed full-time since my early twenties and I’ve gone without self-employed health insurance for much of that time because the gaping hole in Canada’s socialised healthcare has never been as apparent to me as it is now at the ripe old age of thirty-eight.

Surprise health costs woke me up to the need for proper freelance insurance for myself, my wife, and the people I work with.

It’s not that I didn’t want some kind of health insurance for freelancers when I was young and ridiculously healthy –it’s that I figured it would be more trouble and money than it was worth at the time.

Things change, and here we are. That, and freelancer health insurance has often been a tipping point with candidates applying for roles we’ve needed to hire for.

Offering health benefits for freelancers has been the icing on the cake needed to fill remote jobs with A-list candidates, whether we have a team of 2 or a team of a hundred.

Health Insurance for Entrepreneurs

I suggest you visit their website to see exactly what your policy will look like, but here’s the Coles Notes:

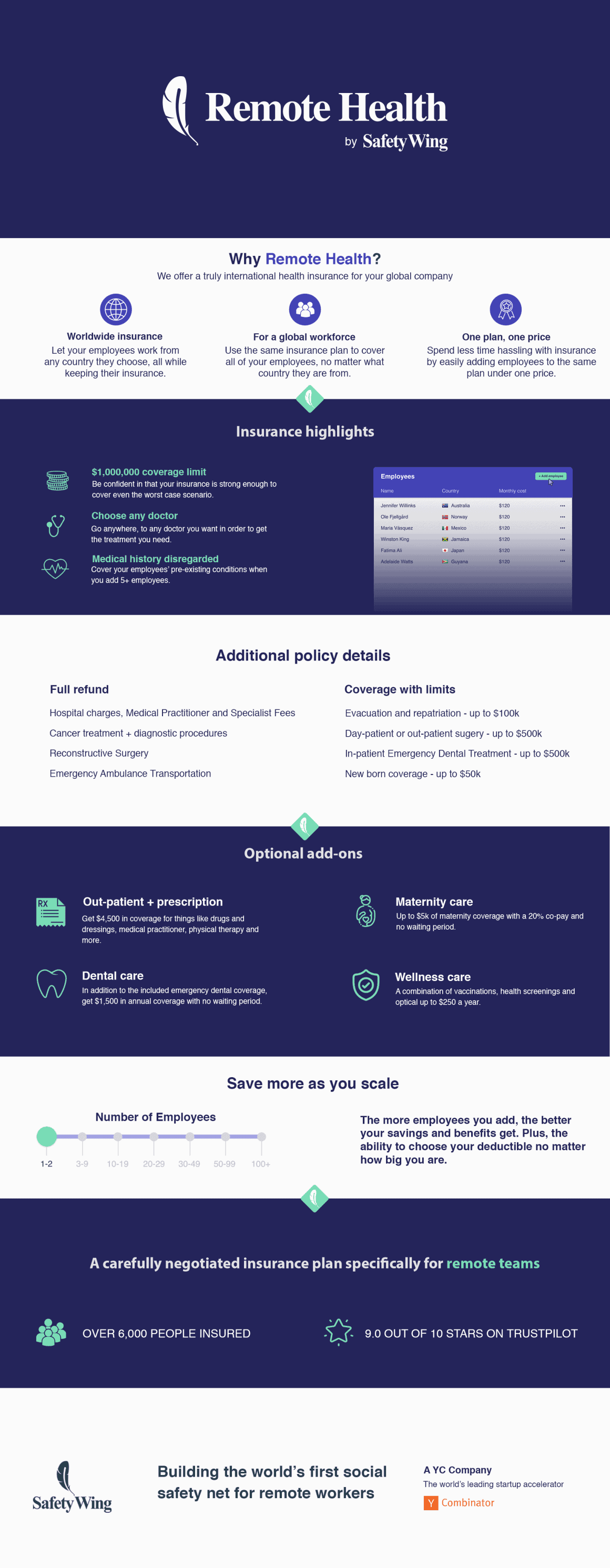

- People under your plan can be located anywhere in the world

- Employee pre-existing conditions are covered for plans with 5+ employees; those covered can go to any doctor of their choice and enjoy a $1,000,000 coverage limit

- Upfront fees will be reimbursed, such as doctor fees, ambulance transport, and those related to cancer treatment and/or reconstructive surgery

- Prescriptions, physiotherapy and more are covered; up to $4,500 for outpatient coverage

- Dental coverage is also available

Safetywing’s Remote Health works for some of our team, but it doesn’t cover one country I think is important –Canada (me) currently isn’t covered (but it’s going to be soon).

In the meantime offering healthcare for freelancers we hire abroad is another way to cultivate loyalty from our staff. We adjust their salary accordingly, it’s not an extra cost for us to offer it.

Learn MoreGo Into Greater Detail

You can customize your freelancer health insurance plans depending on the unique needs of those you choose to cover –which means this article is only part of the picture.

There’s an interactive tool to price out exactly what you’re looking for here.

Which self employed insurance do you use? Let us know in the comments and don’t forget to mention which country you’re from!

To learn more about this work from home health insurance business and find out if it’s right for you, visit their website.

Learn More